For measurable and sustainable outcomes

+91 98202 22089

Email: sales@goveva.com

GovEVA

42, Free Press House Free Press Journal Marg, Plot: 215, Nariman Point, Mumbai, Maharashtra 400021

An In-Depth Look at Choosing the Right ESG Management Software

Tuesday, 23 April 2024

Struggling to find the perfect, ESG management software and risk management software for your business? Look no further! In this comprehensive guide, we’ll equip you with everything you need to make an informed decision. From understanding the importance of ESG reporting to the key features of selecting the right software solution, we’ve got you covered.

- Published in ESG Guide

No Comments

Mastering ESG Reporting: A Step by Step Guide for Beginners

Thursday, 29 February 2024

In today’s corporate landscape, businesses are increasingly recognizing the importance of integrating environmental, social, and governance (ESG) considerations into their decision-making processes. ESG reporting has emerged as a powerful tool for companies to transparently communicate their sustainability initiatives, foster stakeholder trust, take sustainability risks and drive long-term value creation. For beginners looking to unlock the

- Published in ESG Guide

A Comprehensive ESG Guide: Compliance Pros’ Vital Role in Business

Thursday, 18 January 2024

In recent years, Environmental, Social, and Governance (ESG) considerations have emerged as a central focus for businesses worldwide. This comprehensive guide explores the fundamental principles of what is ESG reporting and why is it important now, delving into why it is experiencing rapid growth and its indispensable relevance for compliance professionals in today’s business landscape.

- Published in ESG Guide

Why ESG Should Be Quantified?

Thursday, 07 July 2022

The quantification of ESG or better known as Environment, Social, and Governance within the business community has been a debate for quite some time now. Given the nascent stage at which this line of thinking and working is developing, there isn’t much awareness as to why by doing this a business entity’s ESG rating, along

- Published in Uncategorized

Top 3 ESG Myths in the Corporate World

Thursday, 07 July 2022

ESG has become the talk of the town in the corporate space. Although, commonly employed by corporations and governments and within board meetings. Considering the concept of ESG barely existed a decade ago, this is a remarkable development. As nonfinancial criteria become increasingly important for a comprehensive assessment of company risk and performance, it’s important to identify

- Published in Uncategorized

What is double materiality and why should you consider it?

Tuesday, 07 June 2022

The concept of double materiality states that a company should report on matters that deal with sustainability: – Financially material in influencing the business value – Material to the environment, market, and people The concept of double materiality simply defines that the economic materiality of an issue can shift based on anticipated or unexpected

- Published in Uncategorized

What Your Company Should Know About High Impact ESG Issues

Tuesday, 10 May 2022

All organizations, regardless of the size or industry, are prone to non-financial factors that can negatively impact their business. The effects of environmental, social, and governance (ESG) issues on a company’s business are of growing concern for investors, consumers, governments, and other stakeholders. Most companies are prone to a wide range of ESG issues, so

- Published in Uncategorized

Three Easy Adjustments to Your Sustainability Plan That Can Help Boost Your ESG Rating

Wednesday, 20 April 2022

ESG rating is vital when it comes to understanding a company’s exposure to environmental, social, and governance risks that have financial implications. The scenario was different a couple of years ago as compared to what we are seeing today. Only a handful of organizations prioritized sustainability and knew what was at stake. However, times have

- Published in Uncategorized

5 Ways To Save Your Corporate Governance Strategy From Dying

Wednesday, 06 April 2022

1. Increase Diversity Corporate boards suffer from a serious lack of diversity. In a recent study, organizations with one or more women on the board outperformed companies with no women by 4 percent in net income growth. United States companies lead the world in having one or two women or minority board members. 2. Appoint

- Published in Uncategorized

How To Build A Sustainability Plan

Tuesday, 05 April 2022

Organizations must make sustainability a thing of priority if they wish to thrive in a dying world where the competition is fierce. An environment-friendly business can not only bring increased profits but significantly reduce the negative impact on the planet. In an interesting study, it was seen that sustainable-centric organizations generate annual revenue of more

- Published in Uncategorized

5 Quick Tips To Develop an ESG Strategy

Thursday, 03 March 2022

It’s needless to say that ESG performance is vital for any organization to survive in the world wherein climate change, depletion of natural resources, and financial frauds are in abundance. Companies need to buckle themselves up and focus on building a plan that focuses on sustainability. Using our domain knowledge, we’d like to share some

- Published in Uncategorized

How To Ensure Good Corporate Governance In 5 Simple Steps

Thursday, 03 March 2022

1. Balance board composition If all board members have the same level of experience, with similar skill sets, you will not find the diversity of opinion that is required to rigorously challenge the company’s strategy and ensure it is watertight. Greater diversity on boards introduces new ways of thinking and creative methods of solving problems,

- Published in Uncategorized

Carbon and the Climate Crisis

Thursday, 03 March 2022

Introduction A long time ago, we were gifted a pristine planet, a planet which was habitable and where all lifeforms could co-exist. The presence of greenhouse gases was proportionate enough to maintaintemperatures that ensured emergence of life forms as we know them, including humans. Earth’sclimate has changed throughout history. About 12,000 years ago marked the

- Published in Uncategorized

Top Corporate Governance Trends in 2022

Wednesday, 02 February 2022

More emphasis on Cybersecurity Policies 2022 will witness an augmented digital transformation. In contrast, cyber threats and ransomware incidents are likely to rise because of digitalization, remote work, and increased use o third parties; the focus would therefore be on security measures, incident response, board reporting, and communication. The ESG will steal the show Organizations

- Published in Uncategorized

How GovEVA File Manager Can Change The Way You Practice File Management

Wednesday, 05 January 2022

A very core part of your board management process is storing, sharing, and securing files that serve as the backbone of your company’s lifeforce. And for that very reason, we have built the GovEVA File Manager or GFM. This feature allows you to ease your document management process by offering the following benefits: Unlimited Storage

- Published in Uncategorized

3 Core Steps To Effective Compliance Risk Management

Wednesday, 05 January 2022

A major component of running an organization is making sure it is in compliance with external and internal regulations and policies in order to protect it from the risks caused by non-compliance. We are listing down 3 steps to effective compliance risk management: STEP 1: Set a framework to identify your obligations The first step

- Published in Uncategorized

5 Easy Steps to a Carbon-Neutral Future for Your Business

Wednesday, 05 January 2022

Achieving zero-carbon has become the new norm for businesses across the world. Organizations have started to realize the consequences of climate change and the stature of the threat it poses to an individual and a nation. If you are a part of an organization that is looking to accomplish the goal of zero-carbon emission, then

- Published in Uncategorized

Top 5 ESG Focused Companies That Are Changing The World

Tuesday, 07 December 2021

The significance of ESG is growing rapidly across the world. Companies have started hitting the pedal to the metal to structure their ESG strategy, and so we thought it would be great to list down the top 5 best ESG focused companies in the world to inspire other organizations to go the extra mile and

- Published in Uncategorized

Insight from The Board’s Perspective: The Promise & Perlis of Data

Monday, 04 October 2021

Over the past 1 year, the board largely focus on the agendas related to business continuity during the Pandemic. And at the same time, it is important to look after the Obligations related to Cyber security. The Board members are finally waking up to the real risks that cyber security threats can pose to companies

- Published in Uncategorized

Sustainability Reporting in 2021 – Order The Mayhem!

Tuesday, 28 September 2021

By Shailesh Haribhakti and Thara TK In the last two years, global agglomerations of capital represented by sovereign wealth funds, pension and provident funds, insurance funds, mutual funds, private equity funds and alternative asset funds have begun to demand a continuous monitoring of ESG (Environmental, Social and Governance) readiness. Quite apart from ESG diligence, there

- Published in Uncategorized

How GovEVA’s Progress Meter Can Help Your Company

Tuesday, 21 September 2021

Keeping a daily track of the business operations is of topmost priority, and when it comes to Corporate Governance, the stakes are even higher. GovEVA Boards features a Progress Meter that efficiently tracks your compliance activities and also provides you a roadmap to scale up your Corporate governance levels. To have a better understanding of

- Published in Uncategorized

Business leaders jump on ESG bandwagon, sustainability a key focus

Monday, 13 September 2021

India’s first and only ESG certified Director, Shailesh Haribhakti, in a freewheeling chat with Ritu Kant Ojha, Editor, Wiyld, says sustainability is no more just a tick mark in the boardroom discussion items. It is now right at the centre, with chief executives steering sustainability committees. Apart from being on Boards of 20 plus companies like

- Published in Uncategorized

Shifting Focus To Total Shareholder Return – A Take On ESG By G.N. Bajpai

Sunday, 12 September 2021

When the future of capitalism is threatened, companies need to change gears from mere profit maximisation to profit with purpose. Currently, the flavour of the global narrative beyond Covid-19 is “WITHER CAPITALISM”. The narrative is pervasive through the corridors of academics, C-suites, citizens’ forums to political chambers, albeit in different nuances of inequality, environmental degradation,

- Published in Uncategorized

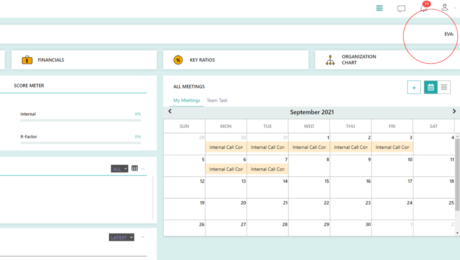

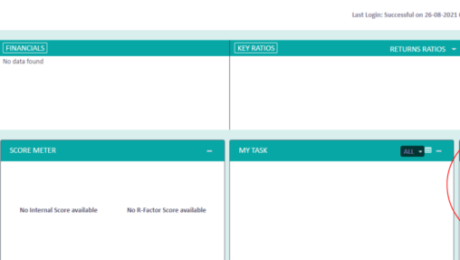

What is GovEVA’s EVA Feature and How It Can Help Your Organization

Tuesday, 07 September 2021

Today it is imperative for corporations to consider the welfare and concerns of multiple stakeholders in their strategic decision-making. The government, society at large, climate-change activists, suppliers, vendors exert an influence directly or indirectly in company policies. GovEVA understands this shift in power from shareholders to a larger ecosystem of stakeholders. Yet we believe in

- Published in GovEVA Feature

What Is The Company News Feature and How It Can Help You

Friday, 27 August 2021

Gone are those days when you have to depend on your team to stay updated with the activities that are going around in the company. Not only is this approach archaic and prone to human errors, but it’s also extremely time-consuming. With the world moving faster than ever, as an integral part of your organization,

- Published in GovEVA Feature

What’s New at GovEVA

Friday, 27 August 2021

Developing and upgrading software is a never-ending process, especially when we are talking about a digital board portal like GovEVA Boards. A board management software typically requires frequent upgrades in order to stay relevant to the industry requirements. After receiving valuable feedback on our product from our esteemed clients, we have decided to take it

- Published in GovEVA Feature

Infosys Aces CRISIL’s Ranking As The Most ESG-Focused Company In India

Friday, 13 August 2021

Earlier in July, Infosys aces CRISIL’s Ranking as the most Environmental, Social, and Governance oriented company in India with an impressive score of 79 on 100. The company scored 86, 68, and 81 on environmental, social, and governance parameters, respectively. The assessment was made based on the publicly available ESG information, keeping into consideration both

- Published in Industry News

IOD Event on the Future of Governance

Tuesday, 17 December 2019

GovEVA’s Shailesh Haribhakti and Jangoo Dalal recently participated in an IOD event at the BSE on the Future of Governance – Governance in 2025, Board Effectiveness, and Annual Performance Evaluation. Several key topics were discussed: – Role of great Governance in attracting FDI – Regulatory Environment and Capital Markets – Risk Management in a Disruptive

- Published in Corporate Governance Enhancement

SEBI OECD Asian Roundtable on Corporate Governance

Wednesday, 04 December 2019

GovEVA’sShailesh Haribhakti recently attended a SEBI OECD Asian Roundtable on Corporate Governance. Here, he walked the group through how the Bluestar organization adopted and is fully compliant with the recommendations of the Kotak Committee (CLICK HERE TO VIEW DOCUMENT). In addition, he also shared the following thoughts: The Evolving Companies Act and SEBI’s LODR

- Published in Compliance Management, Corporate Governance Enhancement

IMC Event on Recent Amendments under Companies Act, SEBI (LODR), SBO, Governance Culture & Ease of Doing Business

Tuesday, 03 December 2019

GovEVA’s Chairman G.N.Bajpai was the Chief Guest at a recent IMC event on “Amendments under Companies Act, SEBI (LODR), SBO, Governance Culture & Ease of Doing Business” #imc #goveva #bod #compliance #sebi #sebilodr #companiesact #sbo #corporategovernance #governance #csr #governanceenhancement #boards #boardofdirectors #easeofdoingbusiness #india

- Published in Corporate Governance Enhancement

ATTENTION: All Company Secretaries and Compliance Professionals

Thursday, 17 October 2019

As a Company Secretary or a Compliance Professional, you know you are a key consultant to the Board of Directors, the Executives, and the broader Company Management. Right from managing key compliances, to providing strategic support regarding corporate governance issues, to managing Board Meetings. So you need to perform your role in a robust and

- Published in Compliance Management